Cash flow management means tracking money coming in and going out of your hotel. It helps you know if you have enough cash to cover today’s expenses.

Many hotels look profitable but still struggle to pay bills on time. This hidden problem is more common than most hotel owners realize.

Cash flow management turns challenges into opportunities for growth. When you master the timing of payments, your hotel becomes stable and more profitable.

Understanding Cash Flow Management in Hotels

Cash flow management tracks every penny entering and leaving your hotel accounts. It covers guest payments, staff salaries, supplier bills, and daily expenses.

Profit shows what you earn on paper, while cash flow shows what you can actually spend. A hotel may appear profitable but still run out of cash to pay its bills.

Hotels face a timing gap between bookings and payments. Guests may book months in advance, but staff and suppliers need to be paid today.

Why Cash Flow Management Is Critical for Hotels

Meeting fixed operational costs: You must pay salaries, utilities, and rent on time each month. Steady cash keeps your hotel running smoothly.

Managing seasonal fluctuations: Peak seasons bring money while slow months barely cover costs. Save during peak times to survive quiet periods.

Maintaining supplier relationships: Paying vendors on time builds trust and strong partnerships. Good payment history gets you better rates and terms.

Ensuring staff satisfaction: Employees count on getting wages exactly when promised. Happy staff stay loyal and serve guests better.

Enabling strategic investments: Ready cash lets you upgrade rooms and buy new technology. You can fund marketing campaigns when opportunities arise.

Building financial resilience: Strong reserves protect your hotel during tough times. Emergency funds help you handle repairs and downturns.

Major Cash Flow Challenges Hotels Face Today

Booking channel dependencies: Online Travel Agency (OTA) platforms take a big cut of your earnings and delay payments for weeks.

Payment processing complications: Virtual credit cards come with extra steps for processing and take longer to verify.

Seasonal Revenue Swings: Peak seasons fill your bank account while off-seasons drain your reserves quickly.

Unexpected expenses: When your equipment breaks or your property needs fixing, you need funds right away.

Market volatility: Changes in the economy or unexpected shifts in the market can drastically reduce your income in a very short time.

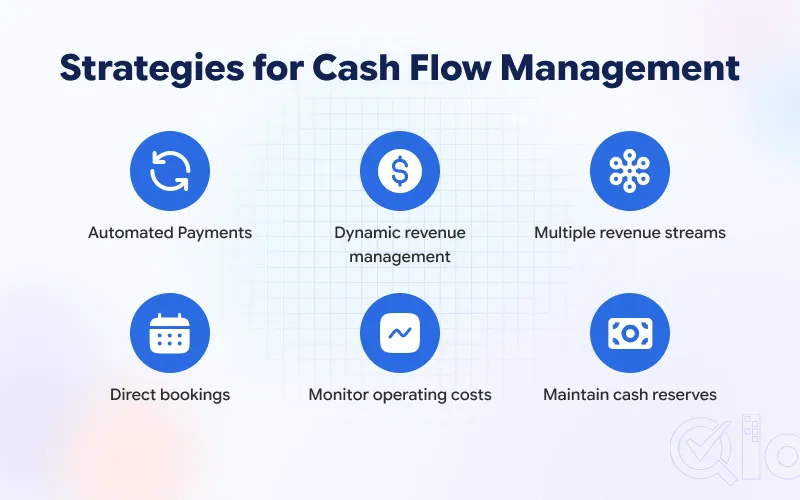

Proven Strategies for Effective Cash Flow Management

Automate payment processing: Automation saves time and cuts down on payment errors. The Property Management System connects directly to your bank for faster processing.

Implement dynamic revenue management: Forecast demand to predict your busy and slow periods. Use dynamic pricing to adjust your room rates based on demand and maximize income.

Diversify revenue streams: Open your restaurant and bar to local customers, not just hotel guests. Host events, offer meeting spaces, and add spa or wellness services.

Optimize direct booking channels: Cut your dependence on OTAs to save money on commissions. Build a strong booking engine on your own website to get paid faster.

Control and monitor operating costs: Audit your expenses regularly to find where you can save money. Manage inventory smartly and negotiate better deals with your vendors.

Strengthen accounts receivable practices: Require deposits and prepayments to get cash before guests arrive. Set clear payment terms for hotels and automate your invoicing.

Build and maintain cash reserves: Save enough money to cover three to six months of expenses. Financial buffers protect you when unexpected problems arise.

How Technology Enables Better Cash Flow Management

Modern hotel software like QloApps gives you complete control over your money. You can see all payments and expenses in real time through one dashboard.

Payment automation connects your bookings directly to your bank account. Money flows in automatically without manual work or processing delays.

Forecasting tools predict your future cash needs based on patterns. Real-time Analytics help you spot problems early and make smarter money decisions.

The Future of Cash Flow Management in Hospitality

More hotels are switching to cashless and digital payment systems today. This trend makes tracking money much easier and faster than before.

Direct bookings will matter even more as OTA commission costs keep rising. Hotels with strong direct channels will have healthier cash flow ahead.

New payment technologies like Payment gateways promise instant settlements and faster processing. Financial flexibility will become the key advantage for winning hotels.

Conclusion

Cash flow management is a survival skill, not optional for hotels anymore. It protects your business and helps you thrive in good and bad times.

Take time today to assess how money moves through your hotel operations. Find the problem areas where cash gets stuck or moves too slowly.

Small improvements in cash flow management create big wins over time. Proactive money management leads to sustainable growth and lasting success.

Get In Touch

If you are a hotel owner and are looking for Free hotel booking software to manage your property. Then QloApps is the best solution for you.

QloApps offers various features to enhance your hotel business. Such as Virtual tours, Tours and Packages, Channel Manager, Front Desk, Cloud PMS, 100+ Add-ons, and many more.

To get started with this user-friendly software. Just download it and add your property to QloApps.

If you have any suggestions, you can share them on the QloApps forum. For any technical assistance, kindly raise a ticket.

Be the first to comment.